The Steel Framing Market in Greece is surging, driven by sustainable construction demands and seismic resilience needs. This guide uncovers key trends, benefits, and investment opportunities for 2026 and beyond.

Steel Framing Market Overview

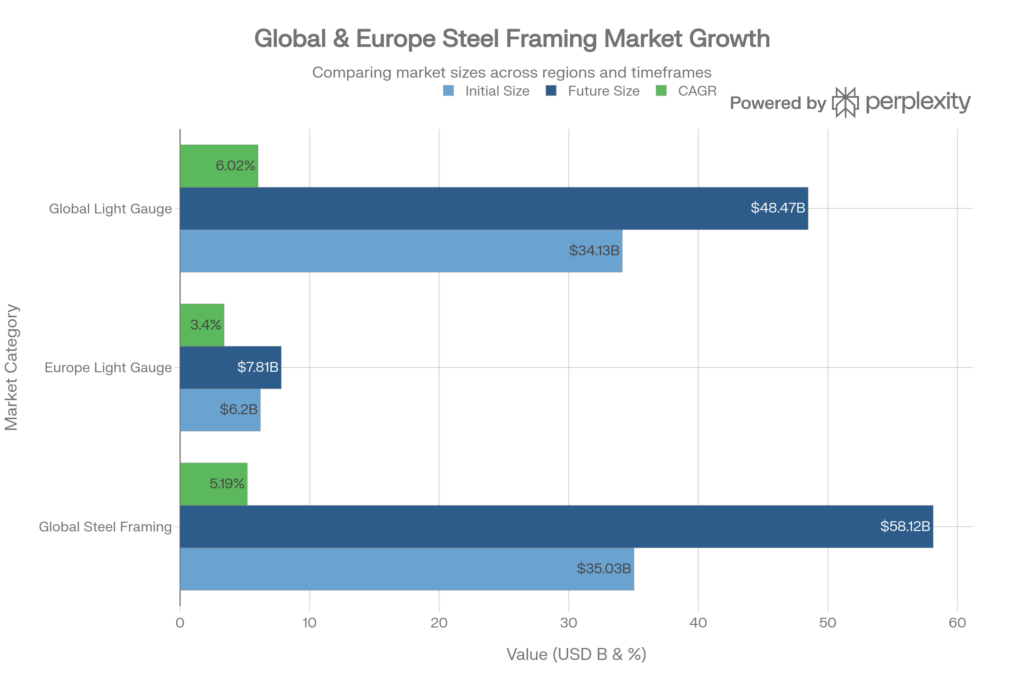

The Steel Framing Market refers to the production and use of steel structures for buildings, including skeleton, wall-bearing, and long-span types. In Greece, this market is projected to grow significantly, starting at 5.15% in 2025 and accelerating to 14.47% by 2029, fueled by construction recovery and green building mandates. Moreover, Europe’s broader steel framing sector emphasizes light-gauge systems for efficiency, with Greece benefiting from EU standardization.

For instance, steel frames offer superior strength-to-weight ratios compared to concrete, making them ideal for residential, commercial, and industrial projects. Additionally, as urbanization rises, demand for prefabricated steel solutions is booming globally, valued at around USD 50 billion in 2024 with a 6% CAGR toward 2026.

Why Steel Framing Market Thrives in Greece

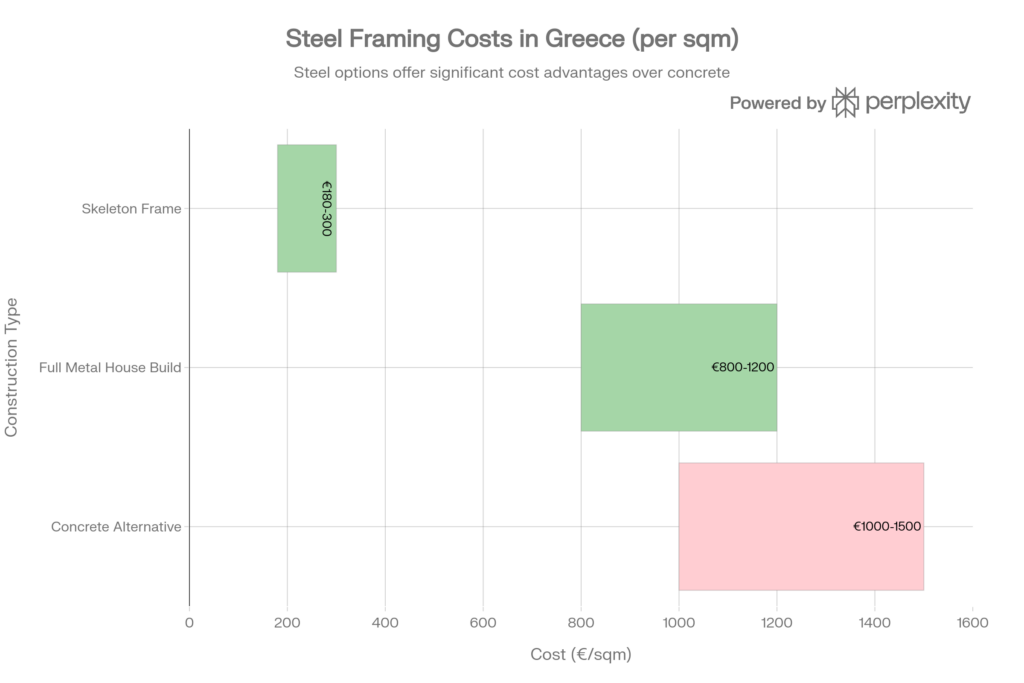

Greece’s seismic activity makes steel framing a top choice, as it provides exceptional earthquake resistance through flexible designs. For example, costs for a steel skeleton range from €180-300 per square meter, covering high-quality grades like S355 with anti-corrosion treatments. Consequently, a 100 sqm home skeleton costs €18,000-30,000, often 20-30% of total build expenses.

Furthermore, government initiatives promote energy-efficient materials, aligning with EU sustainability goals. In fact, steel’s recyclability reduces environmental impact, while off-site prefabrication cuts labor needs amid shortages. Thus, adoption rates are climbing, especially post-2025 economic rebounds.

Transitioning to practical advantages, steel framing enables faster assembly—up to 50% quicker than traditional methods—minimizing site waste and weather delays.

Key Drivers in Steel Framing Market

Several factors propel the Steel Framing Market forward. First, rising construction activity, including residential and commercial booms, demands durable solutions. For instance, commercial end-uses lead revenues, followed by industrial applications like warehouses.

Second, fluctuating raw material prices pose challenges, yet innovations in automation and AI design lower costs. Additionally, regulatory updates for building codes favor steel over alternatives like masonry.

On the other hand, restraints include competition from wood or concrete, but steel’s longevity (50+ years) and low maintenance win out. Therefore, investors eye Greece’s market for its 2.07% stable growth by 2027.

Steel Framing Market Trends for 2026

Looking ahead, the Steel Framing Market will integrate digital twins and modular tech for precision. In Europe, long-span frames suit logistics hubs, with CAGR projections at 3.4% for light-gauge systems. Moreover, Greece’s focus on post-earthquake rebuilds accelerates this.

Additionally, ESG compliance boosts demand, as steel is 100% recyclable. For example, Germany’s standards influence regional adoption, emphasizing energy-efficient facades. Thus, by 2031, Greece’s volumes will surge across types like skeleton framing.

Want to see real-world steel structure innovation? Discover my cutting-edge portfolio projects HERE where design meets unbreakable engineering to revolutionize your builds today!

Benefits and Cost Breakdown

Steel framing excels in speed, sustainability, and versatility. Specifically, it integrates insulation easily, achieving superior thermal performance. Furthermore, lighter weights reduce foundation needs, saving 10-20% on groundwork.

Cost-wise, beyond the skeleton, add cladding, roofing, and finishes for full homes at competitive rates versus concrete. In Greece, total metal house builds emphasize anti-seismic specs, vital for regions like Agios Dimitrios.

However, to maximize ROI, pair with expert suppliers. External insights: Explore detailed Greece forecasts here. Also, global trends analysis here.

Challenges in Steel Framing Market

Despite growth, raw material volatility impacts margins. For instance, steel price swings affect 20-30% of budgets. Additionally, skilled fabricators are scarce, though prefab mitigates this.

Regulatory hurdles, like strict EU codes, require certified designs. Nevertheless, opportunities abound in R&D for hybrid systems.

Future Outlook and Opportunities

By 2031, Greece’s Steel Framing Market will expand across end-uses, with commercial leading. Opportunities lie in industrial expansions and green retrofits. For example, import-export stats show rising EU trade.

In summary, while challenges persist, strategic investments yield high returns. Builders adopting steel now position for 2026’s boom.